A fresh perspective for group tax law

From the beginning, LeitnerLeitner has focused on working with its clients to manage the many challenges associated with corporate and group tax law. Accordingly, we advise international corporations and groups of companies in all matters related to their cross-border activities.

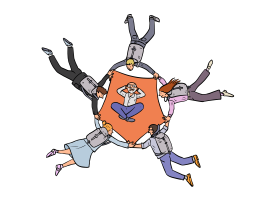

Our teams consist of experts who contribute their technical knowledge from a variety of disciplines. In this way, we are able to find resilient and workable answers to many complex tax issues – including international tax burden comparisons, the application of double taxation treaties, compliance with on-going tax return obligations and extensive cross-border restructuring processes at groups of companies.

Together with a proven network of international specialists, we make sure that the available tax options are utilised – worldwide.

Our services

- Development and implementation of tax-efficient structures, taking into account international requirements

- National and cross-border restructuring of groups of companies

- Strategic tax reviews and international comparisons of tax burdens

- Formation of tax groups

- European and international tax law

- Tax rulings and negotiations with fiscal authorities

- Support and assistance with company audits

- Proceedings before the Federal Court of Finance, the Higher Administrative Court, the European Court of Justice, arbitration proceedings

- Implementation and assessment of tax control systems

- Transfer Pricing