Getting the most out of research premiums

The research premium ensures that Austria is considered a very favourable location when it comes to obtaining financial support.

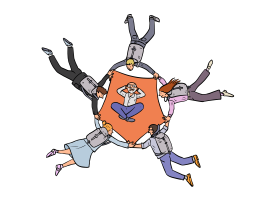

Our experienced experts offer a combination of tax/procedural know-how, business expertise and specialised knowledge of the requirements that apply with regard to the preferential treatment of research and development activities. Our team assists you from the time you submit your application until the premium is paid out. We are also there to help if you are asked to defend the research premium during an audit. In this way, you can be sure that your company gets the most out of the research premium.

Our services

- Optimisation of assessment basis

- Identification of all preferentially treated R&D activities

- Support with FFG (Austrian Research Promotion Agency) process

- Timely preparation of documentation

- Defence in audits

- Expert opinions for audits

- Support with the analysis of subsequent corrective options and procedural aspects

- Individual research premium workshop

- Establishment of a tax control system for the research premium